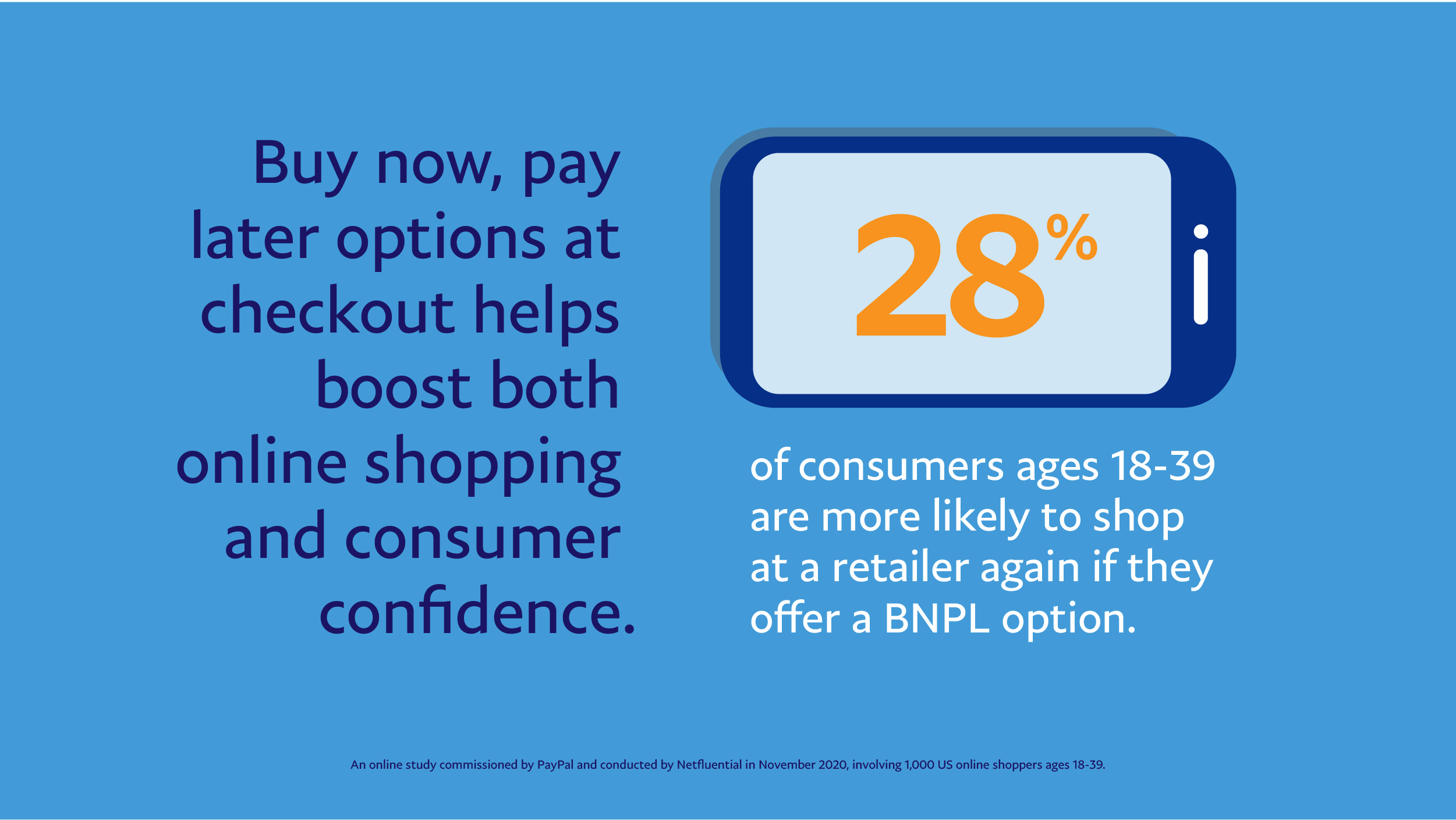

PayPal is now expanding functionality for their “Buy now pay later” options with a longer-term payment plan as the company just enabled users to cover the cost of a purchase over a few interest-free payments.

Pay monthly is also another feature issued by Web bank for users in the United States. It is valid for purchases between $199 and $10,000 and the cost will be split across monthly payments of between 6 to 24 months. If you select the pay monthly option at checkout, you will have to complete an application that will have to be approved and then you’ll be able to select from three payment options that have different time frames.

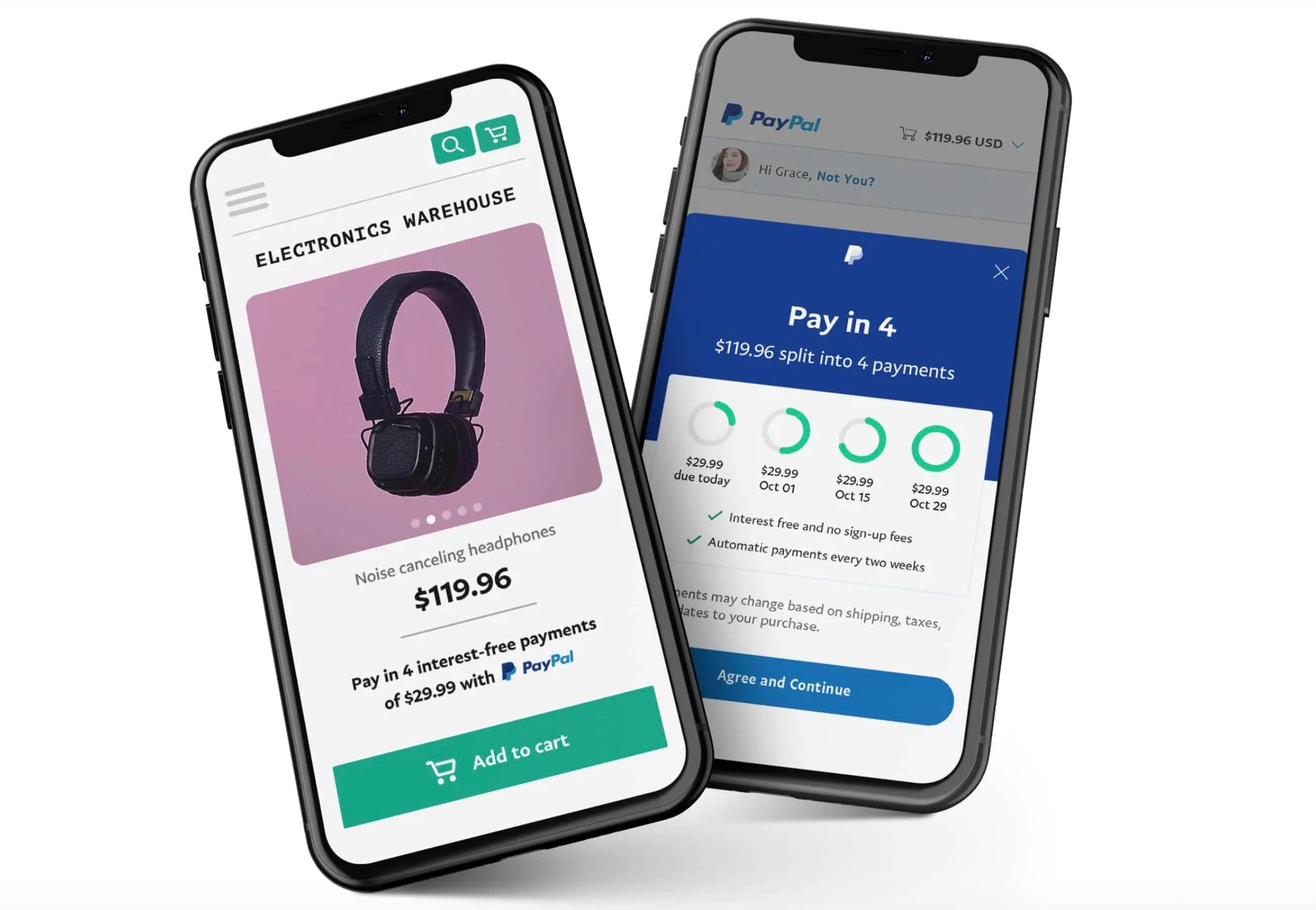

Users will be able to set up automatic payments from debit cards or bank accounts, and also be able to manage payments directly via PayPal on mobile as well as on the website. With their latest option, PayPal is now getting out ahead of Apple Pay later, which will roll out as part of iOS 16 later this year. This is more aligned with the PayPal payment in four options, which users will be able to use to make 4 equal payments over six weeks without any interest or late fees.

This move by PayPal and other companies like Apple and Squares well really indicates a bigger trend in the Major tech world, which shows they are moving deeper into lending, which is a finance sector primarily in the domain of banks, but now it does not seem certain.